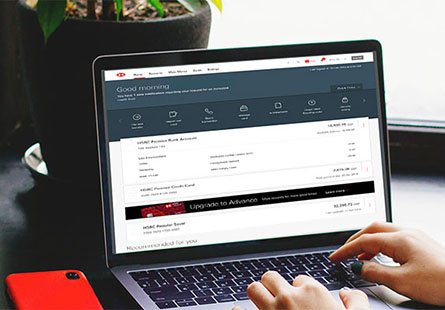

Coming Soon – We’re enhancing your HSBC Online Banking experience

What’s changed?

- Updated look and feel, easy to use features

- Simplified and consistent design to make it easier to move money

- New, useful links located on top of Account Summary page

- Sending money to individuals or companies with Real-Time Payments (RTP®)

- Faster and easier to manage account details

- View your pending card transactions in real-time

Not registered?

Existing Customers

Online Banking Features

Balances and Statements

- View your account balances and transactions

- Historical statements are available online for credit card and Select Credit accounts.

- View form 1099-INT3 when you’re signed up for Personal Internet Banking

Move Money

- Move money easily between your eligible HSBC and non-HSBC deposit accounts using a Bank to Bank transfer4

- Send a wire from your HSBC account to another person, business, or financial institution

Desktop |

Mobile App |

|

|---|---|---|

View account balances |

||

Bank to Bank transfers |

||

Mobile check Deposit |

||

Online Registration |

||

Bill Pay |

|

View account balances |

|

Desktop |

|

Mobile App |

|

|

Bank to Bank transfers |

|

Desktop |

|

Mobile App |

|

|

Mobile check Deposit |

|

Desktop |

|

Mobile App |

|

|

Online Registration |

|

Desktop |

|

Mobile App |

|

|

Bill Pay |

|

Desktop |

|

Mobile App |

Explore Online Banking

Go paperless

With eStatements, you can view, download or print an electronic version of your statement.

Move Money

Your needs vary, so we offer flexible options for moving your money.

Pay your bills

Pay bills to anyone in the U.S. - online, anytime. It's convenient and free.

Frequently Asked Questions

Online Guarantee

Terms and Conditions

1 All HSBC Personal Internet Banking clients with an HSBC personal checking, savings, Certificate of Deposit (CD) or credit card account are automatically covered. HSBC's $0 Liability, Online Guarantee is applicable to client transactions covered by Federal Regulation E. The guarantee does not cover business and commercial accounts, accounts at other financial institutions, or accounts that are not covered under Regulation E. The $0 Liability, Online Guarantee assumes notice of fraudulent activity on eligible accounts is provided to HSBC within 60 days, and timely notice on card accounts. Assumes client follows account safeguarding, personal firewalls and online security diligence practices outlined in HSBC's Security & Fraud Center.

2 Data rate charges from your service provider may apply. HSBC Bank USA, N.A. is not responsible for these charges.

3 Form 1099–INT is a statement reporting to the IRS interest income you received on checking, savings and investment accounts. HSBC Personal Internet Banking customers will not receive Form 1099–INT in the mail unless specifically requested through a secure BankMail within Personal Internet Banking. Paper versions of Form 1099–INT will continue to be sent by mail for HSBC accounts that do not qualify for online Forms 1099.

4 Transfer limits may apply only to transfers made online through the Bank to Bank Transfers service. HSBC reserves the right to apply a lower limit.

5 Under the Bill Pay 'on-time' guarantee, HSBC will bear the responsibility for any late-payment-related charges should an online bill payment arrive after its due date as long as you scheduled the transaction in accordance with the HSBC Personal Internet Banking Terms and Conditions. This guarantee does not apply to business clients using Bill Pay.

6 Canceled checks will be retained for six years. Canceled checks will be retained for seven years for Washington state residents. A reconstruction fee may apply if you request a total checking reconstruction (copies of all checks and/or statements) for one or more checking statements. Check images are available for 365 days from the day the check posts to the account. Additional restrictions may apply.

Data rate charges from your service provider may apply. HSBC Bank USA, N.A. is not responsible for these charges. Camera-in device required to be able to utilize HSBC Mobile Check Deposit. Deposit amount limits may apply. HSBC Mobile Banking App is available for iPhone®, iPad®, AndroidTM devices and must be downloaded from the App StoreTM or Google PlayTM.

iPhone and iPad are trademarks of Apple Inc., registered in the U.S. and other countries.

Android and Google Play are trademarks of Google LLC.

App Store is a registered trademark of Apple Inc.

RTP® is a registered service mark of The Clearing House Payments Company LLC.